Highly developed countries canalise almost 50% of equity flows to tax havens

The Netherlands and the United Kingdom top two facilitators

24 juli 2017

An Offshore Financial Center (OFC) is a jurisdiction (often a country) that provides corporate and financial services to non-resident companies on a scale that largely exceeds the size of its economy. The CORPNET team draws attention to the popularity among large multinational corporations of using OFCs to move capital across borders and (mostly legally) reduce their tax bills.

Analysis of 98 million firms

CORPNET aims to create more transparency in the heated debate on tax havens and offshore finance. Eelke Heemskerk, associate professor at the department of politics and principal investigator at CORPNET: “Given the contested role of OFCs it is surprising that we still lack a broadly accepted definition of what they are. Instead, the identification of OFCs has become a politicised and contested issue. To remedy this, we set up a team of political scientists and computer scientists who together developed a novel, data-driven approach that simply measures how corporations make use of particular countries and jurisdictions in their ownership structures. We created algorithms that analyse the entire global network of corporate ownership structures, with information of over 98 million firms and 71 million ownership relations with surprising results”.

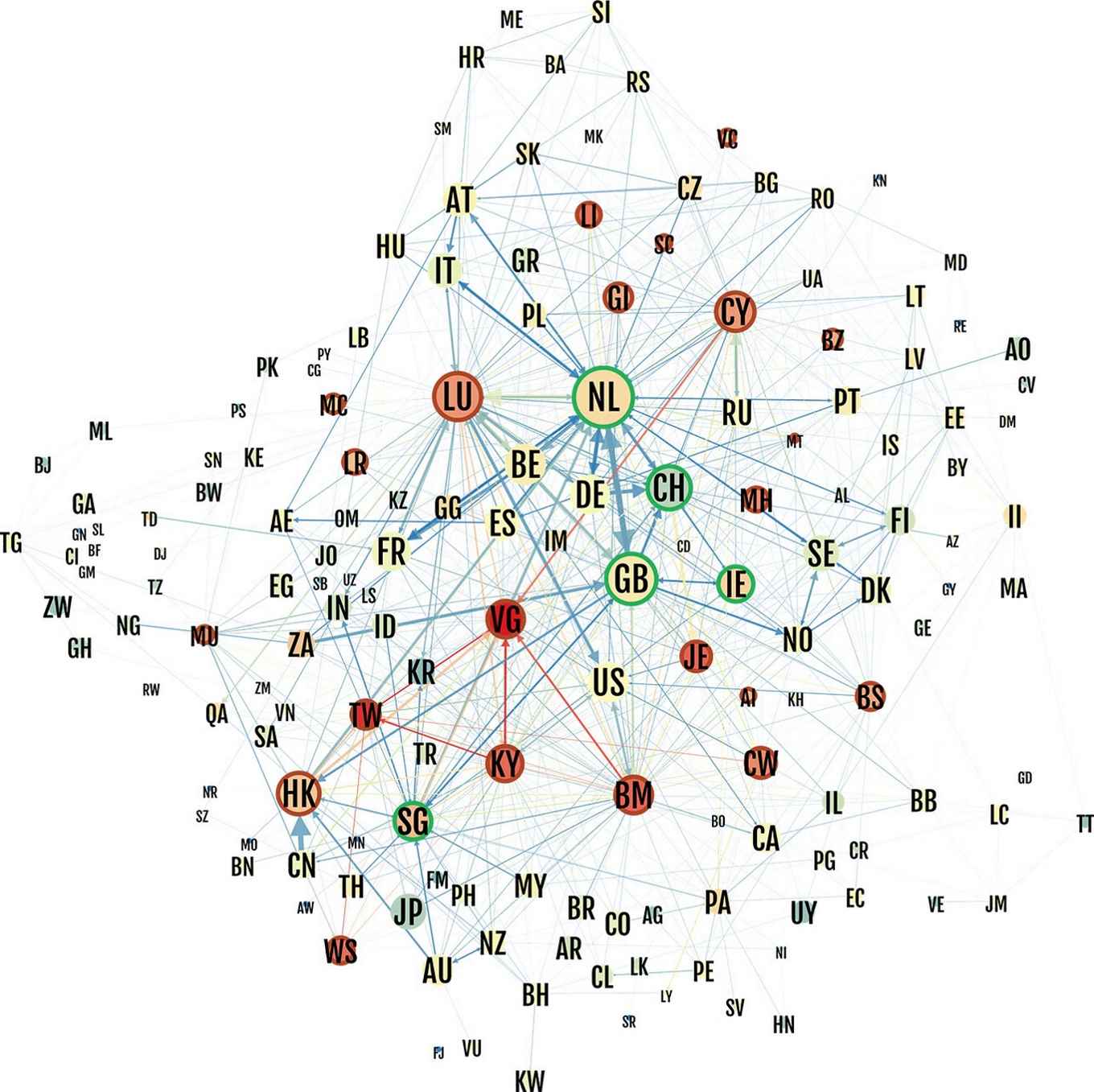

Network of relationships between countries

Tax havens and their facilitators

Earlier methods that tried to identify Offshore Financial Centers typically looked at country-level statistics (such as Foreign Direct Investment), without providing insight in Offshore Finance flows across the globe. The network analytic approach taken by the CORPNET team allows them to see not only where investment flows originate and end up, but also the intermediate destinations they pass through. This results in two types of OFCs: ‘sink-OFCs’ or the typical tax havens that attract and retain foreign capital, and ‘conduit-OFCs’, through which disproportional amounts of value move towards sink-OFCs, enabling the transfer of capital without taxation.

The ‘big five’

CORPNET identifies 24 sink-OFCs, including well known offshore jurisdictions such as Luxembourg, Hong Kong, the British Virgin Islands, Bermuda, Jersey and the Cayman Islands. The research shows that only five big countries act as conduit-OFCs: the Netherlands and the United Kingdom, followed by Switzerland, Singapore and Ireland. Together these five conduits canalise 47% of corporate offshore investment to sink-OFCs. The Netherlands and UK are the largest players with 23% and 14%, followed by Switzerland with 6%, Singapore with 2% and Ireland with 1%.

Table of sink and conduit-OFCs

Countries with a present or past colonial relationship to the United Kingdom are highlighted in blue.

Policy implications

The distinction between sink-OFCs and conduit-OFCs has important potential implications for efforts to target tax avoidance. The authors show that while OFCs are often portrayed as small, exotic islands that are almost impossible to regulate, many OFCs are in fact highly developed countries that have the means to intervene. “Starting from the idea that some countries act as facilitators and some as tax havens we were able to characterize the role and importance of each country in the world, which can have a real impact in policy’, says Garcia-Bernardo, data scientist at the UvA’s Department of Politics.

The five major facilitators can play their role as crucial hubs of corporate investment only because they have a good reputation, political stability, highly developed legal systems, and because they have signed numerous tax treaties with other countries. This means the necessary conditions to function as a conduit-OFC are only present in a small number of developed countries.

Since the global financial crisis, the European Commission and the OECD have increased pressure on tax evasion, with modest effects. CORPNET hopes that their approach can help regulators target the policy to the sectors and territories where the offshore activity is concentrated. As the conditions for conduit-OFCs outlined above can only be found in a few countries, targeting conduit-OFCs could prove more effective than targeting sink-OFCs.

Publication details

J. Garcia-Bernardo, J. Fichtner, F.W. Takes and E.M. Heemskerk: ‘Uncovering Offshore Financial Centers: Conduits and Sinks in the Global Corporate Ownership Network’ in Scientific Reports, 2017. doi: 10.1038/s41598-017-06322-9|

http://www.nature.com/articles/s41598-017-06322-9